Miss the budget speech last week?

No worries, the team at Wise About Life has put together a little highlights package for you.

What you might not know is that treasury was looking to raise R40 billion in extra taxes over the course of four years. Fortunately, we dodged that bullet this year, but there’s still no need to send Tito a thank you card. Rocketing commodity prices saved the day, and tax collections in 2021 and 2022 are expected to be much higher than was originally anticipated.

Not everything was peaches and cream though.

Fewer goods and services were produced in South Africa compared to the previous year: 7.2% less to be exact. Unemployment rose from 30.8% to 32.5% between October and December 2020.

COVID 19 has been blamed for this whole mess, but to be honest, we were in trouble long before the lockdown started, and the global pandemic seems to have just added fuel to the flickering flames of an already burning recession.

So, who can blame you for expecting to pay higher taxes in 2021? The strange thing is that the exact opposite actually happened.

So, what will be changing in 2021?

No additional taxes for you 🙂

Now the sceptics among you are immediately going to cry foul!

“Well, if they aren’t increasing income taxes, where will the money come from?”

Turns out that Treasury spotted an opportunity with excise duty a long time ago. As always, excise duty on cigarettes and alcohol will increase, this time by 8%, which is well above inflation.

There has also been a slight adjustment in the income tax bands.

There is nothing better than a healthy annual increase at work, but nothing worse than having to pay more tax because you now fall into a higher tax bracket. Fortunately, Tito thought of us and income tax brackets were stretched by 5%.

Last year the 18% tax bracket stood at R1 – R205 900.

This year it been increased to R216 200.

For those on the other end of the scale – the 45% tax rate earners – the bracket was raised from R1 577 301 to R1 656 601. We’re certain they are just as happy.

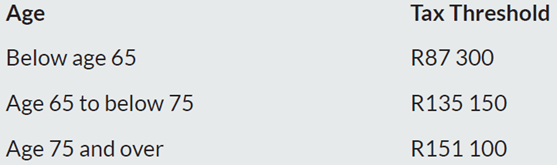

Tax thresholds were increased.

This is the amount you need to earn (per annum) to start paying tax. Stay under the threshold and you won’t have to pay any income tax.

Last year, for those below age 65, the threshold was R83 100. This year it rose to R87 300.

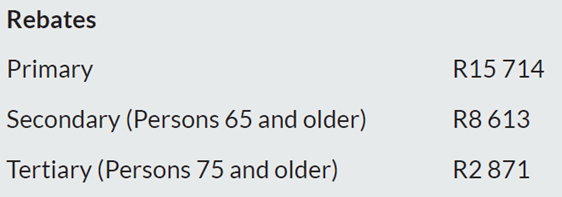

We also have a rebate increase.

What is a tax rebate?

Every taxpayer is entitled to at least one of the three rebates. Think of it as a discount on your taxes, compliments of our Government. These rebates increased by 5% as well:

Medical tax credits have increased.

Last year you could claim R319 per month per person for the first two members on your medical aid. Additional dependants were entitled to R215 per month per person.

This is now R332 per month per person for the first two persons, and R224 per month per additional dependant.

The price of petrol has increased.

The general fuel levy will increase by 15 cents per litre, while the Road Accident Fund levies will increase by 11 cents per litre. The carbon tax will increase by 1 cent to 8 cents per litre for petrol and 9 cents per litre for diesel from the 7th of April.

You know what this means for the cost of living – the knock-on effect of an increase in the petrol price means it will be more expensive to get to work and the cost of groceries, amongst other things, will increase as well.

As a country, we are sliding deeper and deeper into debt and no solution appears to be on the table other than cutting the budget for education and policing, two of the areas that arguably need more funding, not less. The cost of servicing our debt alone has grown from 3.5% of GDP four years ago to 4.7% in the past tax year. Three years from now this is estimated to rise to 5.6%.This means, by way of example, that R5 of every R100 that you earn pays only the interest on your debt with no plan or money to ay off the loans.

But that’s the future, and we must live in the present. Fortunately, the individual taxpayer has been spared in this budget. Next year might be a completely different story.

We would love your thoughts on the budget speech, and how you are planning to manage your finances this year.

Until next time.

The Wise About Life Team

One Comment

The worst tax season I’ve ever experienced. For the first time my tax filing did not have a payback. This is so disappointing.